What you learn

✅

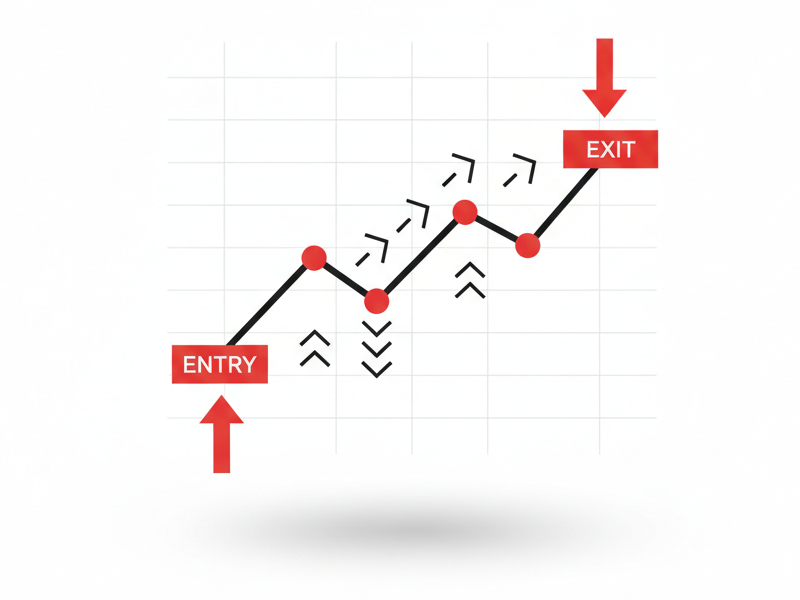

Building Trading Strategies

✅

Proper Backtesting

✅

Strategy Statistics Analysis

✅

Avoiding Over-Optimization

✅

Preparation for Prop Firm Challenges

✅

Systematic Approach to Trading